What is a part-time CFO?

What is a CFO?

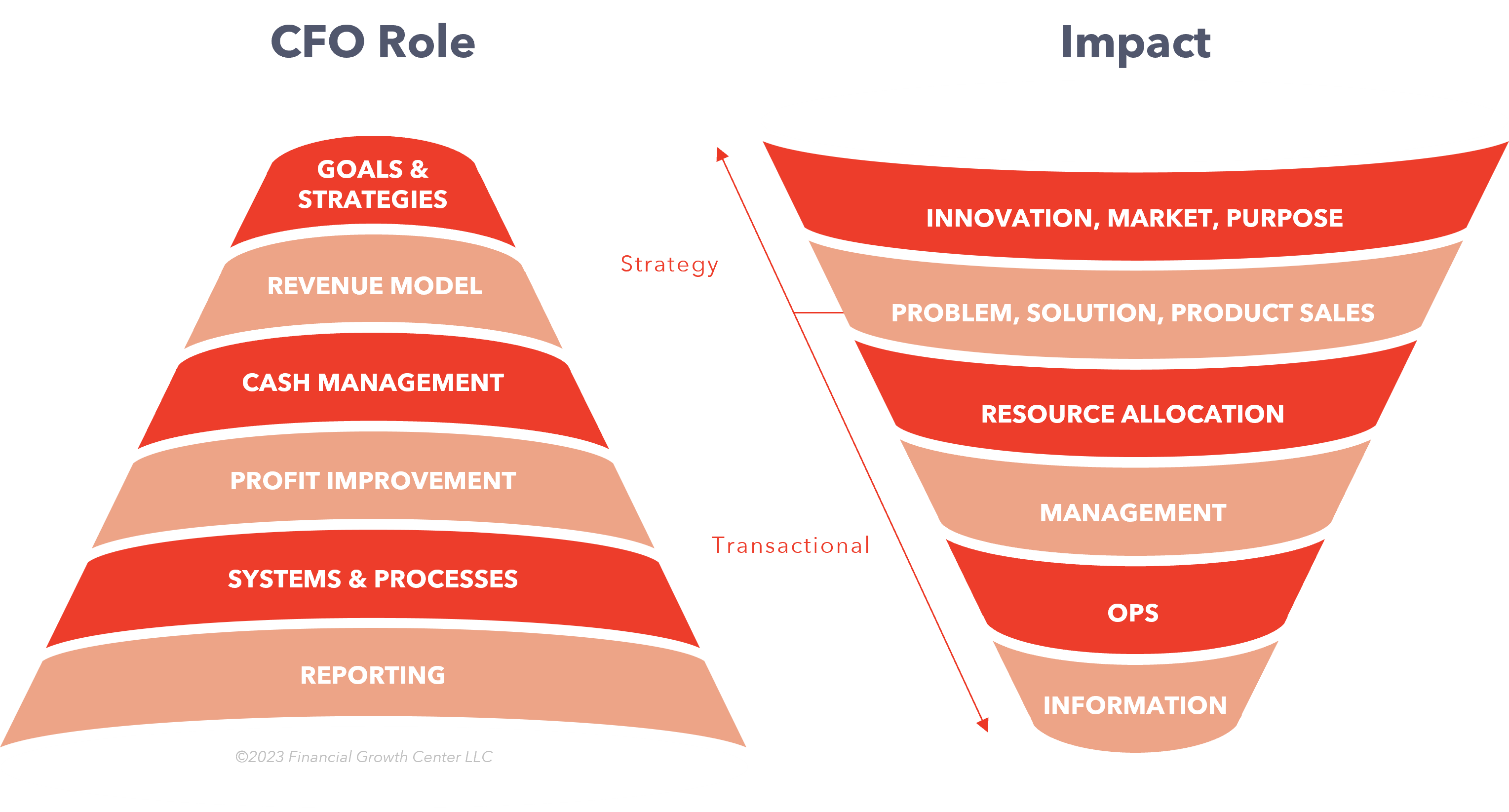

A CFO is the Chief Financial Officer, an executive charged with leading and managing financial operations in a company. The CFO partners with the CEO, COO, sales and marketing leadership and other key roles that drive strategy and vision.What does a Chief Financial Officer (CFO) Do?

The CFO provides insight, guidance and management of a company’s financial functions. This can include:- Key performance indicators and financial metrics

- Managing relationships with banking, investments and funding, capital and debt

- Managing and reporting on the company’s present financial situation

- Forecasting and planning

- Nurturing other key financial and logistical relationships such as legal, accounting, taxes and more.

What is a Part-Time or Fractional CFO?

A part-time or fractional CFO, sometimes called a Virtual CFO, is an outsourced financial officer who assumes the roles and responsibilities of the chief financial officer but isn’t a full-time company employee. At ProCFO Partners, we like to say “A part-time CFO with all-time commitment.”What is the benefit of a part-time CFO?

All companies, of any size, can and should benefit from the unique skill sets of a professional CFO to guide their financial functions. The fractional or part-time CFO is ideal for companies that are:- Needing to reset/restructure their goals and strategies due to market conditions.

- Experiencing stagnant or declining revenues

- Looking to raise capital, exit, or buy

- Seeking to restructure their financial operations.

- Frustrated because their team is not proactive, only reactive; operational, not strategic; looking backwards, not forwards.

- Missing insightful financial information they need to make informed decisions.

- Lacking the resources they need to support their strategic plans.

- In the case of ProCFO Partners, they want to benefit from a network of highly skilled, seasoned CFO’s that pool together their expertise. There’s nearly no situation that our collection of CFO’s haven’t experienced or successfully navigated.

How is ProCFO Partners different from other outsourced CFOs?

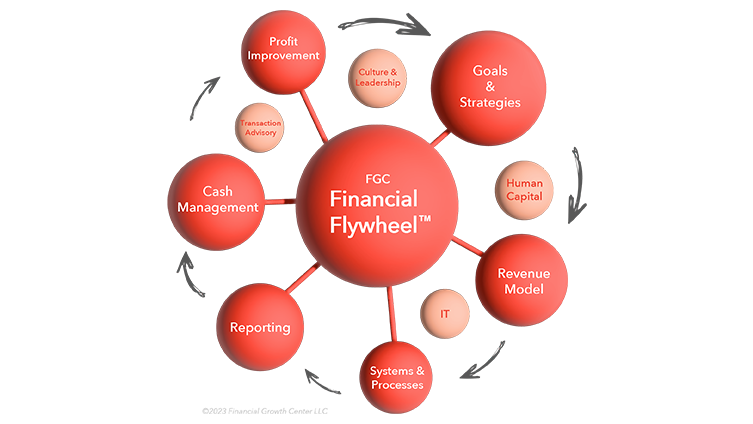

There are two substantial differentiators for ProCFO Partners. The first is the depth and experience of our team. We understand the unique challenges faced by your organization because we’ve seen it before. Each of our CFOs has a minimum of 15 years of experience as a CFO. Many of us have held multiple executive roles. We’ve managed financial operations and provided key leadership for SMB’s, have wide-ranging experience from funded start-ups to complex mergers or acquisitions, and have experience across industries. We’re geographically concentrated in Chicago and New York, making our expertise diverse, well-rounded and accessible. The second is our unique approach, driven by our proprietary Financial Flywheel™, which puts your financial functions in context. We address your current concerns while focusing on solving source issues. We understand the interconnected relationships between and among the financial functions in an organization, and have developed a framework that helps business leaders take action on the right financial functions at the right times for the right reasons. In the hands (and minds) of our capable CFOs, the Financial Flywheel™ dramatically simplifies what can otherwise seem complex or daunting, and provides focus and clarity on the real issues an organization is facing for higher financial performance.

Sign Up for Our Newsletter

Get expert perspectives and actionable strategies to empower your business growth.

"(Required)" indicates required fields