Business Transactions: Understanding the Flywheel of Business Evolution

May 5, 2022

In this article, we’ll seek to simplify what seems complex: Transactions. To understand transactions in business, we have to go beyond buying and selling and dive into motivating, contributing and complementing factors. As a company is younger and smaller, for instance, it might take on transactions that, years later, no longer serve its vision. An owner-driven organization might make transactions to simplify that person’s life or responsibilities, while a large enterprise answers to stockholders and investors. Read on as we explore how the reasons why can help focus the mechanics of how and when.

Understanding Business Transactions

Business transactions are agreements between two or more parties that involve the exchange of goods, services, or money. Transactions can be classified into different types depending on what they involve. We’re considering a transaction as exchanging assets that help a business grow for our purposes. These can include buying or selling a business, sometimes involving a merger.

For this reason, we want to consider transactions as more than just buying and selling. How transactions serve a company, who they serve, and why, and when growth maneuvers like buying or simplifying measures like selling a company occur in the life of a business speak to the evolution of that business. Let’s explore what that means and why it’s essential.

The Evolution of Transactions

How transactions serve a company

Early on in a company’s life, they might take on a lot of transactions to overcome a lack of resources or built-in talent, expertise or relationships. In other words, a company might acquire other organizations that help them meet efficiency or innovation goals, reach more customers, expand their services or offerings or widen their portfolio of products. They might have to take on an investor here for a project, finance things there in a particular way, or do some creative structuring to have the resources to grow.

On the other hand, a more mature company might be looking to simplify as they seek an exit strategy. Or they may be making transactions to minimize risk or tax exposure or mitigate other issues. Now we’re starting to connect to the why of business transactions.

Why transactions occur

Besides the business benefits we’ve explored, there can be other reasons a business is considering significant action.

A large, global or enterprise organization is likely seeking business advantages like some we’ve discussed. Achieving these advantages can involve complicated, complex relationships with financing, oversight, compliance, and even governments. A public company is accountable to stockholders, investors, or a board.

A small or mid-market company might also be motivated by these issues. Still, there’s often a more personal reason like succession planning or estate planning, especially for business owners concerned about legacy or name reputation. Their motivation, particularly in a sales transaction, may not be to sell to the highest bidder. Their decisions may more deeply consider their employees or family to make sure others are taken care of. Naturally, now we’re exploring who business transactions most serve.

Who benefits from the business transaction?

Sometimes, especially in larger organizations, board members, CEOs, investors or stockholders most benefit from the transactions involved in growing the company. In a smaller business, the community, family, or owner might benefit most. We can’t disengage the who from the why because one informs the other. More complex transactions will involve increasingly necessary financial, legal or strategic guidance that will incentivize others as part of the process.

When do business transactions make sense?

You’re seeing now how inter-related the motivations are behind business transactions. Certain kinds of transactions make sense to help an organization achieve some goal. These goals should drive the when.

In 2002, for example, eBay purchased online payment processor PayPal as a seemingly natural part of its business and service offering. In addition to customers benefitting from a smoother, more seamless way of managing transactions, eBay benefitted from leveraging fees and surcharges inherent to the revenue model of PayPal. It also gave eBay more revenue opportunities outside its auction platform as PayPal is used throughout the internet. This acquisition came after eBay bought a smaller competitor, Billpoint, in 1999, only to find Billpoint struggling for market share.

In 2015 the two companies split into independence, with eBay CEO John Donahue saying the relationship no longer made economic sense. A lot has happened in online retail since 2002, including the growth of Amazon and Google as shopping resources. eBay was considered a tech titan in 2002, but by 2015 wasn’t in the same conversation as Facebook, Twitter, Amazon and other online brands. And these weren’t the only transactions eBay was making at that time, as it sold its stake in Craigslist and its enterprise division. As eBay evolved and the marketplace evolved, it made efforts to simplify its model and limit costs and exposure to other risks. These efforts help eBay focus on its core competencies and make them more appealing for a future acquisition. You can see the cycle at work.

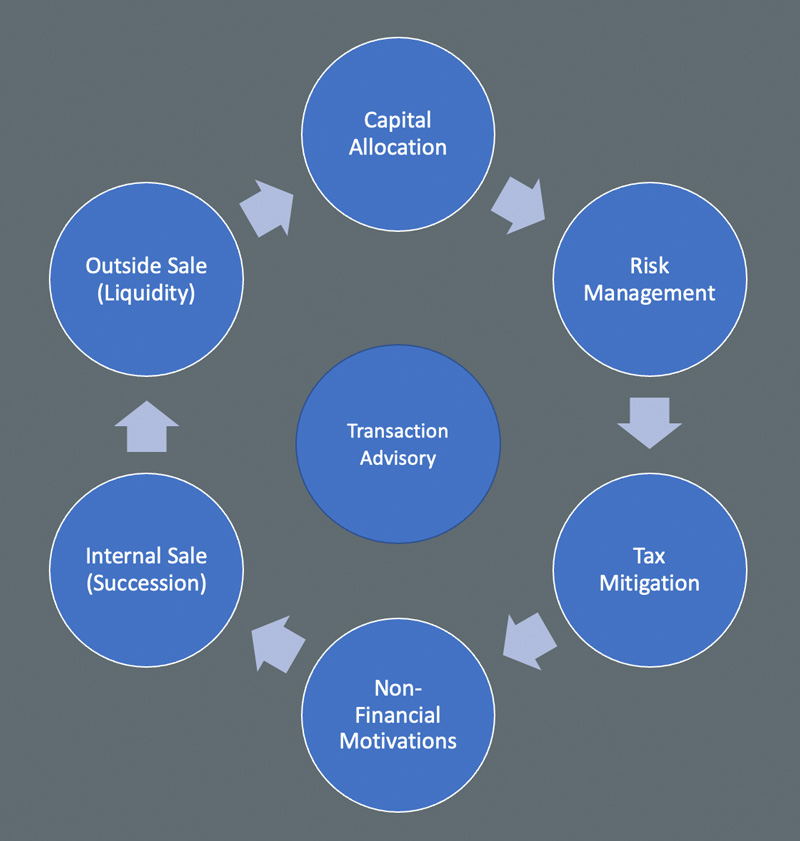

The Transaction Flywheel

Or instead of “cycle,” think Flywheel. At ProCFO Partners, our Transaction Flywheel™ helps describe the factors involved in a relationship to each other and the transaction in general. The Flywheel involves:

- Capital allocation

- Risk Management

- Tax Mitigation

- Non-Financial Motivations

- Internal Sale or Succession

- Outside Sales creating liquidity

- This circles back to capital allocation

Understanding how factors influence and impact each other makes it easier to streamline, simplify, and ultimately create necessary focus.

Business transactions can seem complicated, especially for small and mid-market organizations. Look for financial and strategic partners with experience in these complexities who can help you manage processes and potential to make the first, best, next and smartest decisions for your business – wherever you are in its evolution.

Sign Up for Our Newsletter

Get expert perspectives and actionable strategies to empower your business growth.

"(Required)" indicates required fields